[ad_1]

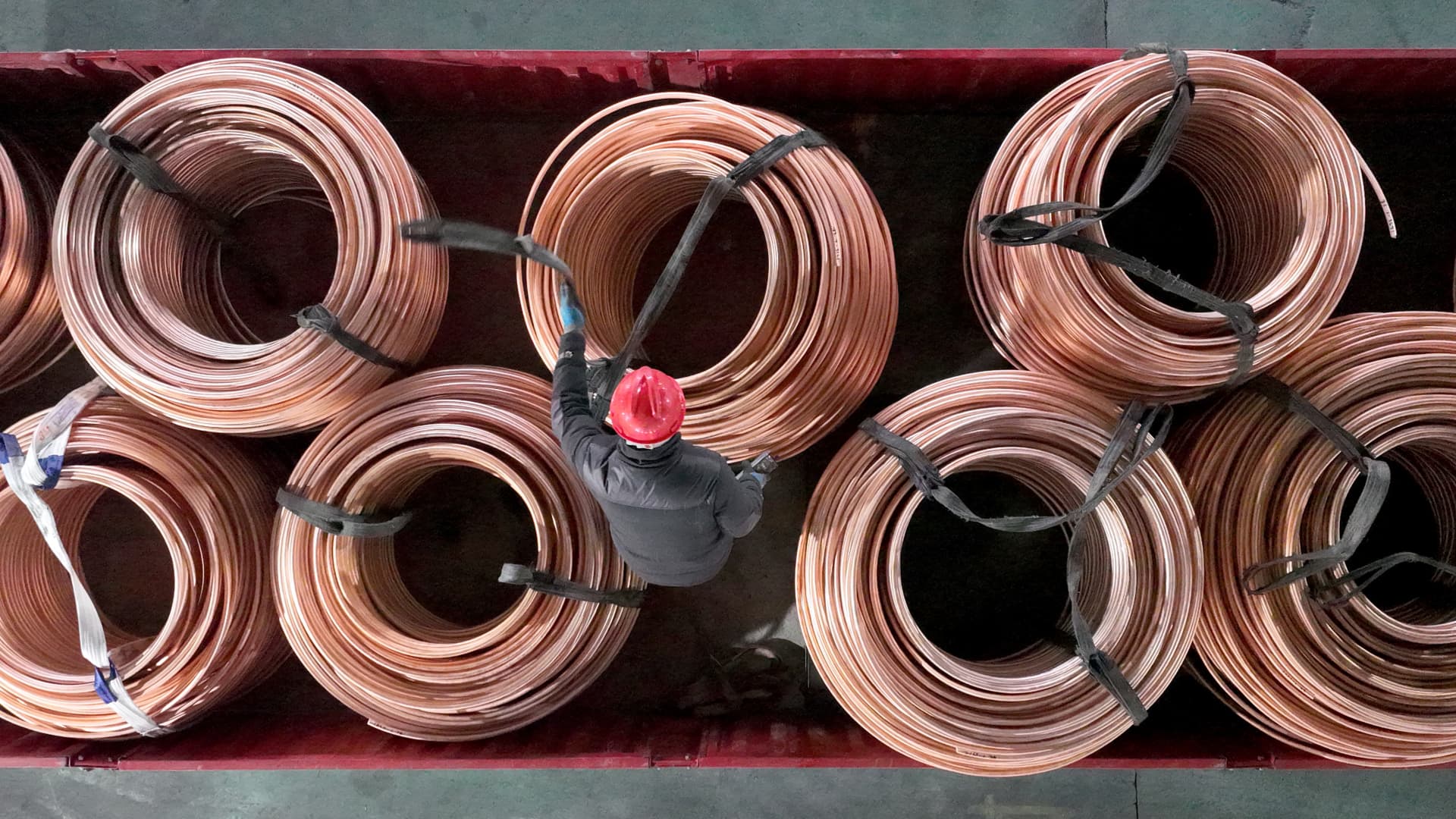

Wall Street is getting very bullish on copper, despite the metal’s recent rallies . The rallies have been fueled by supply risks and rising demand for it amid the energy transition and the artificial intelligence boom. Copper is used in data centers for power cables, electrical connectors, power strips and more, Jefferies noted in an April 10 note. It estimates that global copper demand by data centers will increase from 239 kt (thousand tons) in 2023 to at least 450 kt per annum in 2030. “Our analysis shows that this potential demand growth will exacerbate an underlying copper market deficit, ultimately leading to higher prices,” Jefferies analysts wrote. Data centers house vast amounts of computing power needed for AI workloads, and that need is set to grow as many tech companies are rapidly developing infrastructure for artificial intelligence. Large language models require a lot of data center capacity. In a recent note, Morgan Stanley predicted that the price of the metal will reach $10,500 per ton by the fourth quarter of this year â representing around 12% upside. “Hopes for GenAI / data centre copper demand growth are adding to investor bullishness on copper, against a backdrop of constrained supply,” it wrote. Demand for copper is also widely considered an indicator of economic health. The metal has a wide range of applications throughout construction and industry. It’s also a critical component in electric vehicles, used in batteries, wiring, charging points and more. For those looking to buy into the sector, CNBC Pro screened for stocks in the Global X Copper Miners ETF. The following stocks have buy ratings from 50% or more of analysts covering them, average price target upside of 10% or more, and are covered by at least five analysts. Canadian firm Solaris Resources stood out for having more than 200% potential upside â the highest in the list â and a 100% buy rating. Filo Mining also made the cut, getting 25% upside from analysts and a 92% buy rating. In addition to the Global X Copper Miners ETF, those who want to invest in this sector via exchange-traded funds can consider the Sprott Copper Miners ETF and the iShares Copper and Metals Mining ETF.

[ad_2]

Source link