[ad_1]

Indian companies impacted by the Red Sea disruptions have started taking measures after an impact on their overseas supply chains for both imports and exports due to delay in transit time, increased shipping and insurance costs.

This includes creating an additional pool of working capital to buy raw materials in advance which are imported through that route, air freight to meet urgent demand and negotiation with clients, logistics and insurance companies, industry executives said.

Varun Beverages chairman Ravi Jaipuria told investors recently the company is overstocking the raw materials imported for safety reasons which is “creating some cost.” He said freight rates have become more expensive everywhere, cost of materials has gone up and some of the shipments are getting delayed. It has increased the company’s working capital year-on-year.

“So, that is why we are making it very safe for ourselves and not worrying about additional inventory cost…Some risk protection we are doing with the geopolitical situation. Suddenly the Suez Canal has got blocked and we do not want to take any chances for any goods, safeguarding ourselves,” said Jaipuria.

Companies dealing with confectionery said cocoa prices have shot up the roof and they are trying to procure in advance in bulk. Executives said the global cocoa shortage has been exemplified with the Red Sea crisis.

“Even when we are willing to pay a 25-30% premium price, there is no easy availability of cocoa. This price increase will impact profitability,” said Parle Products senior category head B Krishna Rao.

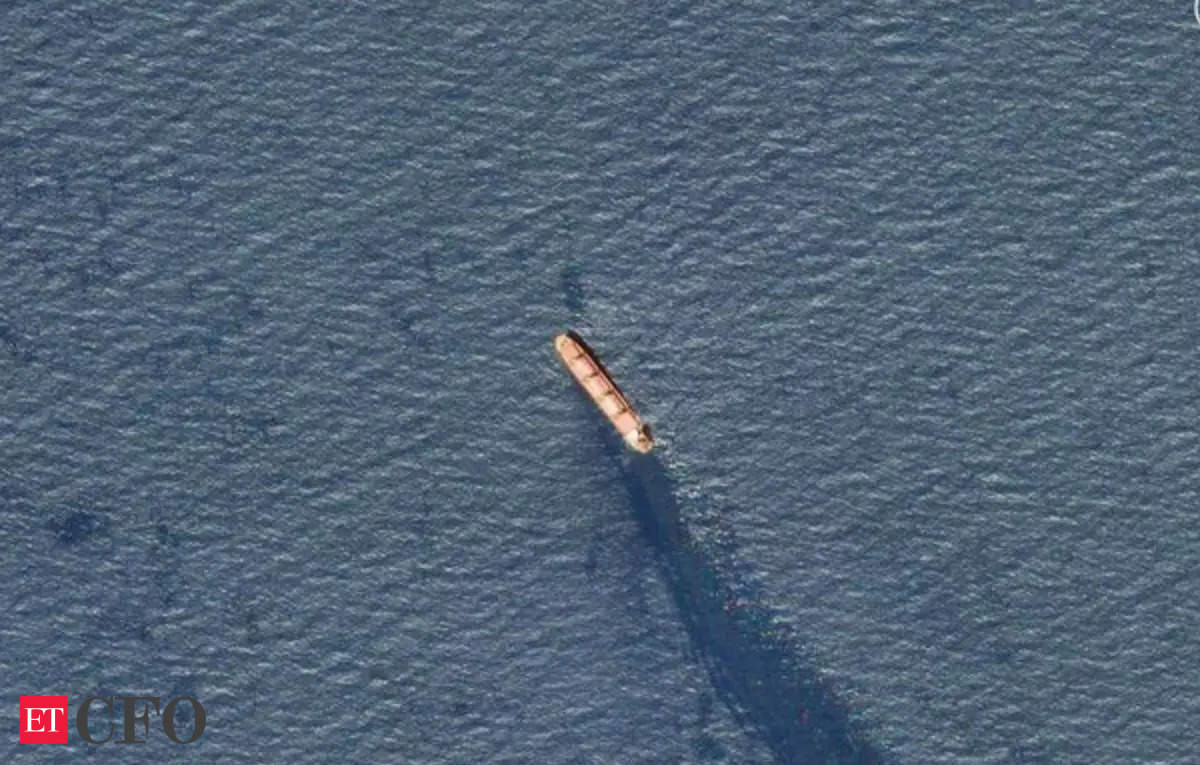

The Red Sea crisis entered its fourth month impacting global trade since this channel is one of the world’s busiest cargo routes whereby carriers have been forced to reroute shipments via the Cape of Good Hope.

Arvind Ltd told analysts that around Rs 20-25 crore of revenue has spilled over into the current quarter from the December one due to the crisis as it could not fulfill all orders due to container logjam. The company is negotiating the freight costs for the goods where it has to bear the freight, but for most orders freight is on the account of the customer, vice chairman Punit Lalbhai said in the recent earnings call.

Gokaldas Exports management told analysts earlier this month that most of the client brands are offsetting incremental insurance by talking to their logistics partner and some are also air freighting to save time.

Car makers, who export cars or import components through this route, said there has been some disruption in their operations. MG Motor India chairman emeritus Rajeev Chaba said some components come from Europe. “If the crisis continues for long, there will be an impact for sure. Already logistics costs have increased and there is a delay in shipments,” he said.

Maruti Suzuki executive director (corporate affairs) Rahul Bharti said since the company’s exports are diversified across about a hundred countries of the world, the Red Sea route affects a small part of the total exports. “And for that part, we have started shipping our vehicles through an alternate route which may lead to slight increase in cost and time,” he said.

[ad_2]

Source link