[ad_1]

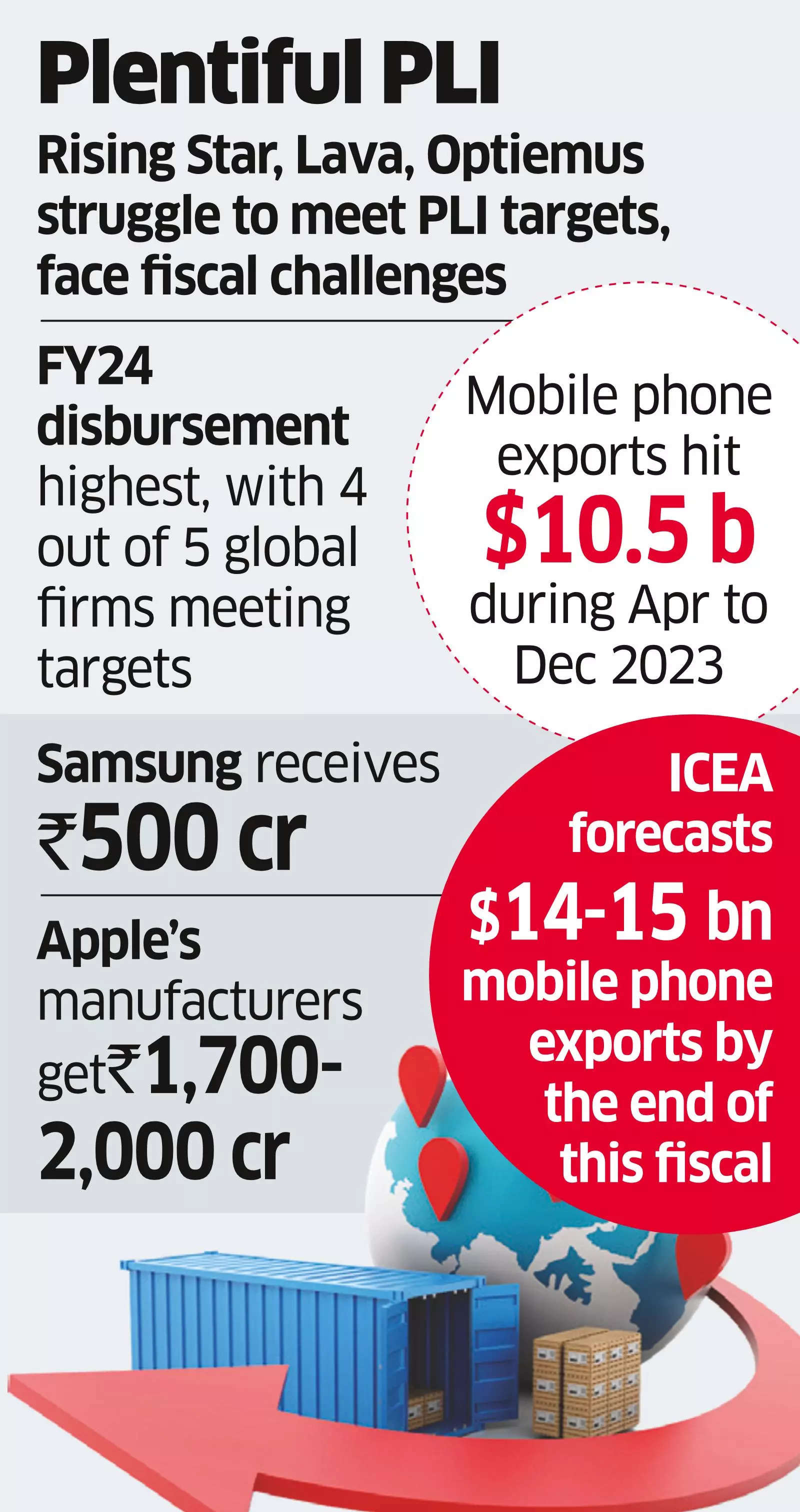

Apple Inc.’s three contract manufacturers in India – Foxconn (Hon Hai), Wistron (now owned by Tata group) and Pegatron – along with South Korea’s Samsung and homegrown electronics company Dixon Technologies are set to get more than ₹4,400 crore in incentives for meeting targets in FY23 under the government’s production-linked incentive (PLI) scheme for smartphones.

However, since some of the ten companies selected have not met the production targets outlined in the scheme, the original planned outlay of ₹6,504 crore for FY24 will not be fully utilised, officials aware of the details told ET. Companies get incentives a year later after achieving targets. The companies exceeding the targets, however, can claim additional sops from the residual amount not claimed by firms, which have failed to meet the targets.

Among global firms, Rising Star (Bharat FIH) – a smartphone contract manufacturer for China’s Xiaomi – has failed to meet the target since the PLI scheme was rolled out in FY21 and is likely to maintain a similar trend in FY23 as well.

Indian companies such as Lava and Optiemus Electronics, who have not met the PLI targets even once, are also not likely to get the incentives, officials said.

Smartphone companies named in the story didn’t respond to ET’s emailed queries.

“As four out of five global firms have met the targets in FY23, the amount disbursed in FY24 will be highest so far under the scheme,” said one of the persons cited above.

So far, the government has released around ₹2,500 crore under the scheme, of which ₹500 crore has been disbursed to Samsung for meeting targets of the first year of the scheme, while ₹1,700-2,000 crore has been released for the three contract manufacturers of Apple and Dixon.

Samsung has now filed claims for meeting targets for the third year after failing to achieve the numbers in the second year of the scheme. Samsung is claiming benefits for the third year while the others are doing so for the second year. FY23 incentives are for targets achieved in the last fiscal ended March 31.

Buoyed by the PLI scheme, mobile phone exports reached $10.5 billion during April to December 2023. Till a few years ago, electronics was placed ninth in terms of export categories but with the commencement of the scheme in 2021, the sector has jumped to the fifth position.

Industry body India Cellular and Electronics Association (ICEA) predicts mobile phone exports to reach $14-15 billion by the end of this fiscal.

The smartphone PLI scheme offers graded incentives in the form of cashbacks at 6% of incremental sales of goods for each of the first two years, 5% for the third and fourth years, and 4% for the fifth year.

Overall financial outlay for the scheme was reduced to ₹38,601 crore over five years from the original ₹40,951 crore. This ₹2,350 crore difference was utilised for the IT hardware scheme.

To qualify for the benefits, companies such as Samsung and Apple’s contract manufacturers need to invest a minimum of ₹250 crore in the first year of the scheme and a similar amount in each of the next three years. In terms of production, the global companies need to manufacture incremental goods (mobile phones with invoice value of ₹15,000 and above) worth ₹4,000 crore, ₹8,000 crore, ₹15,000 crore, ₹25,000 crore and ₹50,000 crore in the final year of the scheme.

Since its start in FY21, the scheme was amended after most beneficiaries failed to meet targets in the first year, barring Samsung.

[ad_2]

Source link