[ad_1]

A planned special resolution framework for real estate for effectively granting greater protection to defaulting firms from bankruptcy proceedings is unlikely to feature in the amendments to the Insolvency and Bankruptcy Code (IBC) that the government is firming up, people familiar with the development said.

After extensive deliberations, the government now reckons that such sector-specific mechanisms within the IBC could dilute the very essence of the bankruptcy law and prove to be counter-productive, they told ET. It is expected to amend the IBC after the general election in April-May.

Some flexibilities, however, could be built into regulations from time to time to facilitate easier resolution in real estate, one of the persons said.

In January 2023, the government had sought stakeholders’ views on the special insolvency regime for real estate under which the adjudicating authority could, at its discretion, apply the IBC provisions only to insolvent projects, instead of subjecting the entire realty company to bankruptcy proceedings.

This plan was backed by the insolvency regulator. It was assumed to expedite resolution of stress while enabling the debtor (developer) to remain focussed on completing its other projects. Such a move would, in effect, allow defaulting promoters to retain control of the firm during the insolvency resolution.

“After due deliberations and consultations, no special framework for real estate is being planned now,” said one of the persons quoted above.

Another person said every sector has its own peculiarities but that doesn’t mean each warrants a special IBC framework.

ET had earlier reported that the government was having a second thought about such a framework. It fears unscrupulous promoters/developers may use any such relief to dump certain housing projects midway after grabbing profits and focus on those that, they think, would fetch them greater returns. Also, the developers can potentially siphon off funds from certain projects. These could eventually compound the woes of home buyers instead of ameliorating them, according to the people cited.

The IBC currently doesn’t stipulate any special dispensation for real estate developers. Homebuyers beyond a certain number, in addition to other creditors, are empowered to drag the entire realty firm to the National Company Law Tribunal (NCLT) even for insolvency in one of its projects.

Also, defaulting promoters run the risk of losing control of companies once insolvency cases are admitted by the NCLT.

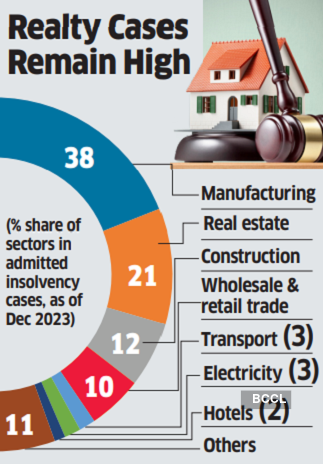

According to the Insolvency and Bankruptcy Board of India (IBBI) data, real estate accounted for 21% of the admitted cases until December 2023, the highest after manufacturing. But it made up only 14% of the resolved insolvency cases.

[ad_2]

Source link