[ad_1]

In 2023, PE/VC investments witnessed the second consecutive year of decline, dropping by 11 per cent year-on-year, primarily due to a decrease in overall deal activity. The number of deals fell by 33 per cent, primarily driven by substantial decline of 42 per cent in the number of deals in the startups segment, revealed a latest report by EY India.

The dollar value of PE/VC investments in startups experienced a steeper drop of approximately 53 per cent, totaling USD 8.8 billion in 2023 compared to USD 18.6 billion in 2022.

Consequently, the startups segment lost its position as the largest segment of PE/VC investments, a position it held since 2021. The share of PE/VC investments in startups fell to 17 per cent, marking its second-lowest level in the past decade, trailing behind 2020, a year significantly impacted by the pandemic and ensuing lockdowns, said the report.

The investment trend in 2023 mirrored that of the previous year, with heightened activity in the first half of the year followed by a slowdown in the latter half.

The first half attracted PE/VC investments of USD 27.5 billion, while the second half saw investments of USD 22.2 billion, as firms exercised increased caution amid rising inflationary pressures, geopolitical conflicts, and impending general elections, all of which contributed to a slowdown in deal activity.

In terms of investment strategy, the decline in pure play PE/VC investments stood out even more starkly compared to the overall PE/VC investments, experiencing a notable 25 per cent year-on-year decrease from USD 40.2 billion in 2022 to USD 30.2 billion, the report highlighted.

However, this decline was partially mitigated by a resurgence of PE/VC investments within the infrastructure and real estate asset classes, which saw a robust 23 per cent year-on-year increase, rising from USD 16 billion in 2022 to USD 19.6 billion in 2023.

There was also a notable decline in large deals in the USD 100 million to USD 500 million range within the growth and startup deal segments of the pure play PE/VC asset class. These deals saw a decrease of over 56 per cent in both number and value, from USD 12.6 billion across 68 deals in 2022 to USD 5.4 billion across 30 deals in 2023.

In terms of sectoral allocation, while infrastructure, real estate, and healthcare sectors experienced growth compared to the previous year, traditional favorites such as financial services, e-commerce, and technology sectors recorded declines.

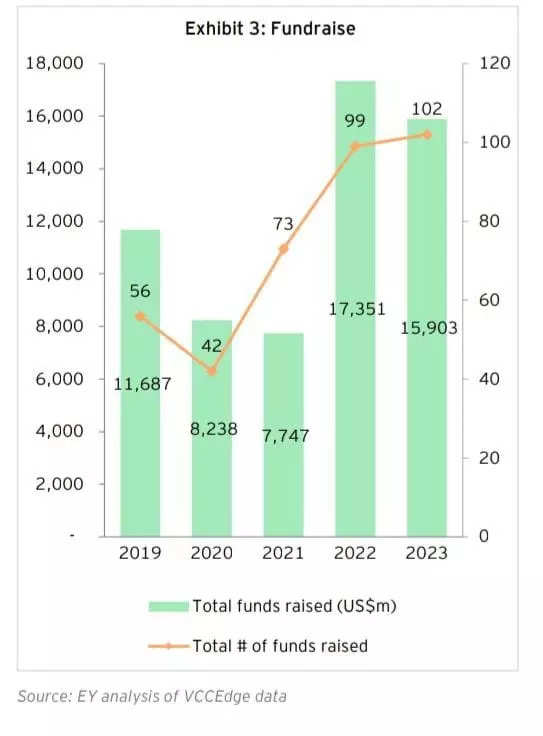

PE/VC fundraising maintained strong growth

Despite the 11 per cent y-o-y decline in value of PE/VC investments in 2023, India continues to maintain its allure, evident from the second-highest dollar value of fundraise, totaling USD 15.9 billion, across 102 funds, which is the highest number of fundraises ever recorded.

The most significant fund raise of 2023 was led by Tiger Global, securing USD 2.7 billion for its Tiger Global Fund 16 targeted at startups in India.

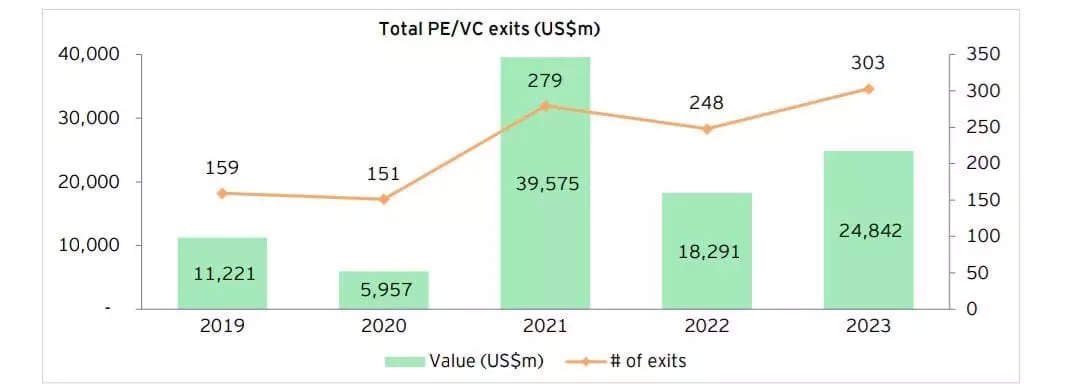

PE/VC exits rebounded

Following a 54 per cent year-on-year decline in 2022, PE/VC exits rebounded impressively in 2023, registering an impressive 36 per cent growth to reach USD 24.8 billion, compared to USD 18.3 billion in the previous year.

This surge was primarily fueled by a substantial uptick in open market exits, which soared by 94 per cent year-on-year to reach USD 12.8 billion in 2023 from US$6.6 billion in 2022. Additionally, 2023 witnessed the second-highest number of PE-backed IPOs ever, said the report.

In terms of exit type distribution, open market exits dominated, comprising 52 per cent of total exits, reaching a historic high of USD 12.8 billion. Secondary exits followed with USD 6.6 billion in 2023, compared to USD 4.8 billion in 2022. Meanwhile, strategic exits experienced a decline, totaling USD 3.5 billion in 2023, compared to USD 5.2 billion in 2022.

The year 2023 also marked the highest-ever number of exits, reaching 303 deals, a notable 22 per cent increase from the previous year. Open market exits surged by 64 per cent to 131 deals compared to 80 deals in 2022, while secondary exits saw a staggering 94 per cent growth, totaling 60 deals in 2023 compared to 31 in 2022, highlighted the report.

Conversely, strategic deals declined by 35 per cent, totaling 75 deals in 2023, compared to 115 in 2022. PE-backed IPOs increased to 30 deals from 18 in 2022, while buyback deals grew by 75 per cent to seven deals from four in 2022.

From a sector perspective, financial services dominated with exits worth USD 7.4 billion, a notable 94 per cent increase from USD 3.8 billion in 2022. E-commerce followed closely with exits totaling USD 2.9 billion, a growth of 67 per cent from USD 1.7 billion in 2022.

[ad_2]

Source link