[ad_1]

The new facility is different from the joint declaration form required by EPF members under Para 26(6) of the EPF scheme.This form is mandatory for those wishing to contribute more to their EPF account when their basic salary exceeds the statutory limit (currently Rs 15,000 per month).

The new facility, also known as joint declaration, allows members to update their KYC details online instead of through offline methods. This is because it enables members to review and modify their personal information on the EPFO portal. By doing so, they can prevent the provident fund authority from rejecting withdrawal requests. Recent reports revealed that EPFO was rejecting withdrawals due to discrepancies in PAN, Aadhaar, and EPFO records. With this new feature, EPF account holders can rectify these errors from the comfort of their homes.

Puneet Gupta, Partner-People Advisory Services, EY India, told ET that the EPFO introduced a standard procedure for processing joint declarations through a circular dated August 23, 2023. This joint declaration, authenticated by the employer, allows employees to update their basic profile details. The EPFO recently launched this feature on its Member e-Sewa Portal, enabling EPF members to easily correct their account details online. Previously, only limited corrections were possible online, while others required physical forms attested by the employer and submitted offline to the EPFO.

It’s important to highlight that most rejected EPF claims stem from discrepancies in official documents like PAN, Aadhaar, and EPFO records. Therefore, it’s vital to ensure that all EPFO records are updated with accurate details to facilitate successful EPF claims.

ALSO READ | EEE investments: Get completely tax-free returns with these investments – PPF, EPF and SSY; check details

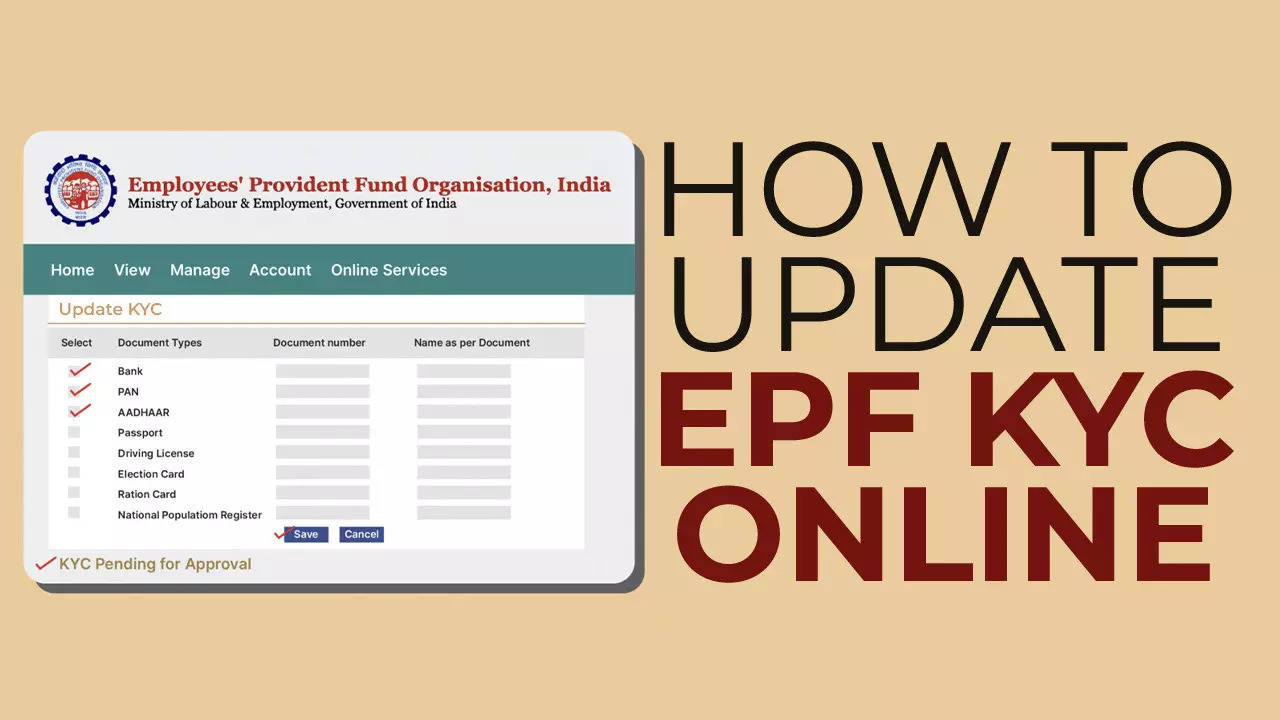

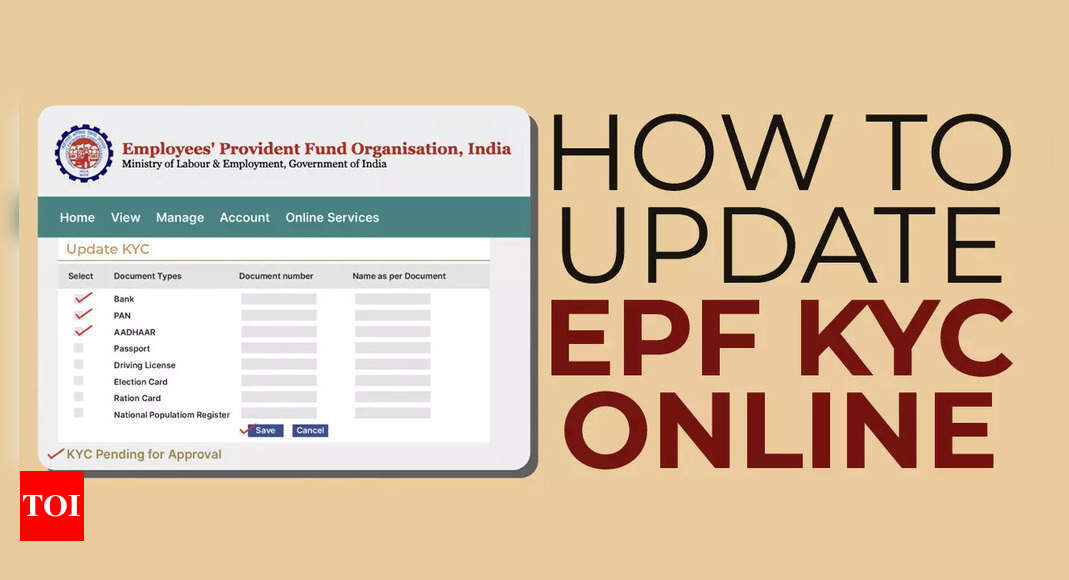

Here’s how EPF members can update their KYC details online:

Pre-requisites

Before beginning the KYC update process, gather necessary documents and remember that certain details have limited correction allowances. EPFO permits updates for 11 personal details and six service-related details.

- Personal details: Name, Date of Birth, Gender, Parental Information, Relationship Status, Marital Status, Nationality, Aadhaar Number.

- Service details: Date of Joining and Leaving EPF, Reason for Leaving EPF, Date of Joining and Leaving Employee Pension Scheme (EPS), Reason for Leaving EPS.

EPFO has outlined a list of acceptable documents that members must submit along with correction requests, depending on the corrections required. For name corrections, Aadhaar is necessary. For date of birth corrections, members can submit a passport, birth certificate issued by the Registrar of Births and Deaths, or other specified documents.

How to update KYC online

Step 1: Visit the Member e-Sewa portal, log in with UAN, password, and captcha. Verify using the OTP sent to your Aadhaar-linked mobile number.

Step 2: Select “Manage” and then “Joint Declaration.” Choose the Member ID where details require correction. For routine KYC updates without changes, use the KYC option under “Manage.”

Step 3: Review EPFO records and make necessary edits in the provided editable box. Consent to Aadhaar verification and click “Proceed.”

Step 4: Upload required documents corresponding to the changes made. Click “Submit” to complete the process.

Successful submission

After successfully submitting the joint declaration, it goes to the employer for approval. The employer verifies the information in their records and approves the request. Any discrepancies may lead to rejection by the employer.

Once approved by the employer, the joint declaration is forwarded to the EPFO office. The changes will appear on the EPFO portal after the PF authority approves them. The KYC update process typically takes 20-25 days. If there’s a delay, members should contact their employer to ensure approval of the joint declaration KYC request.

[ad_2]

Source link