[ad_1]

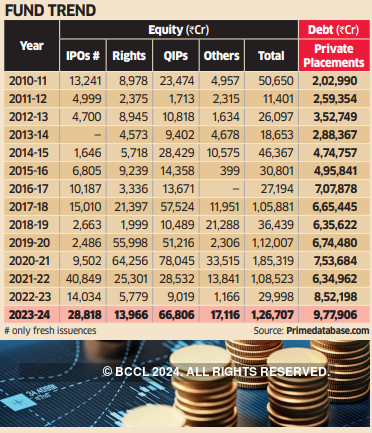

For Indian companies, the bond market was the preferred route for fundraising in FY24 despite equities witnessing a record-breaking run. Fund mobilisation through privately placed corporate bonds touched a record high of Rs9.77 lakh crore in FY24 — a 15% increase over the previous year’s record of Rs 8.52 lakh crore.

Bankers said companies preferred private bond placement in FY24 because it is the most cost-efficient method for raising capital quickly and is cheaper than equities. Fundraising from the equity route, comprising initial public offerings (only fresh issues), quaified institutional placements (QIPs), rights issues, and investment trusts, among others, totaled Rs 1.26 lakh crore in FY24 — the second-highest after FY21. Out of this, Rs 66,806 crore was secured through QIPs. Notably, the peak for QIP fundraising was in FY21, with companies raising Rs 78,045 crore.

FY23 saw a 6-year low equity fundraising. In FY24, a total of 76 companies collectively garnered Rs 61,915 crore, with fresh issues contributing just Rs 28,818 crore, while the remaining amount was generated through offers for sale by existing shareholders.

[ad_2]

Source link